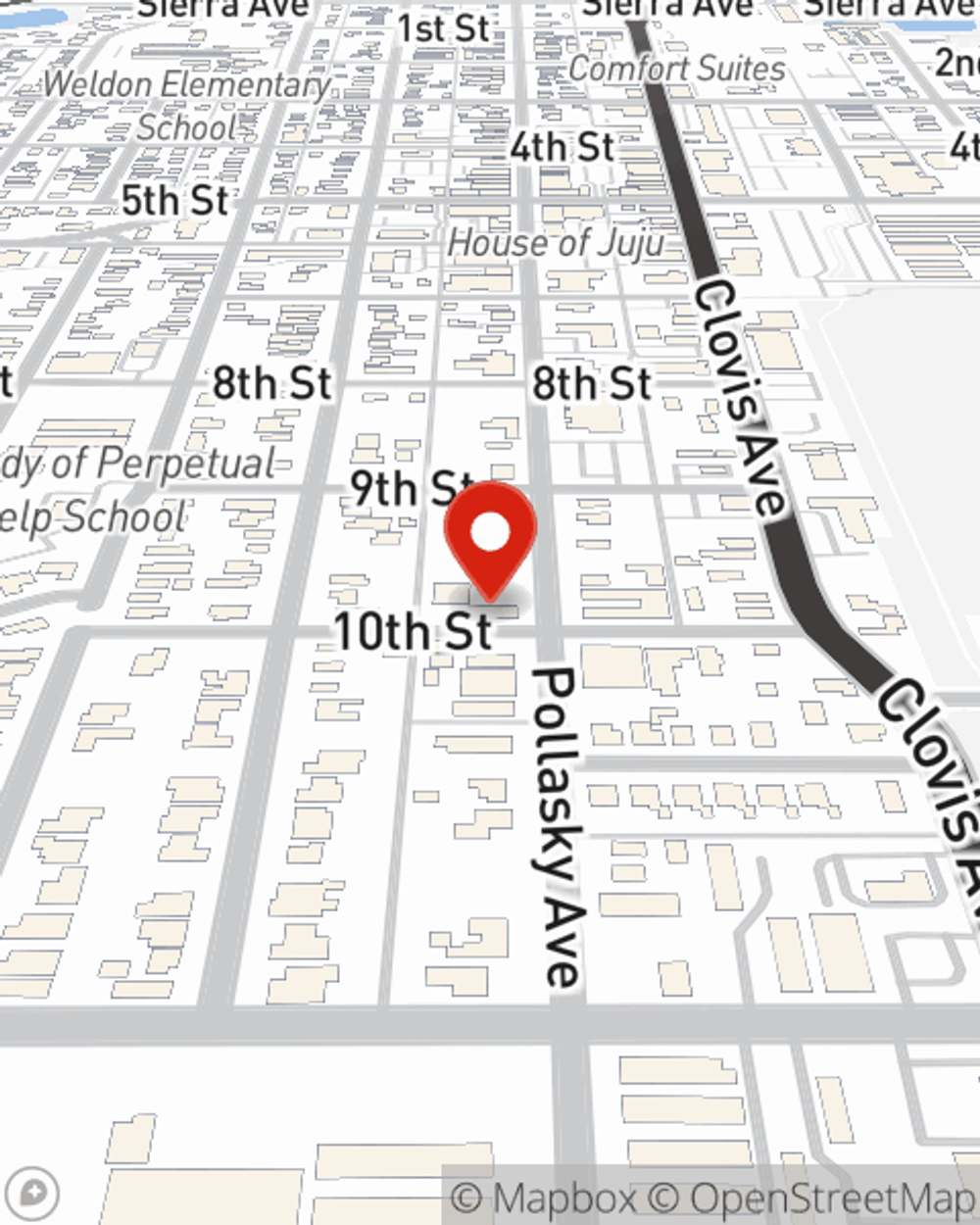

Condo Insurance in and around Clovis

Condo unitowners of Clovis, State Farm has you covered.

Quality coverage for your condo and belongings inside

Calling All Condo Unitowners!

Are you committing to condo ownership for the first time? Or have you owned one for a while? Either way, it can be a good idea to get coverage for your unit with State Farm's Condo Unitowners Insurance.

Condo unitowners of Clovis, State Farm has you covered.

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your condo and its contents protected. You’ll get coverage options to fit your specific needs. Luckily you won’t have to figure that out alone. With empathy and fantastic customer service, Agent Juan Covarrubias can walk you through every step to help generate a plan that guards your condo unit and everything you’ve invested in.

Clovis condo owners, are you ready to explore what a State Farm policy can do for you? Call or email State Farm Agent Juan Covarrubias today.

Have More Questions About Condo Unitowners Insurance?

Call Juan at (559) 299-9221 or visit our FAQ page.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Juan Covarrubias

State Farm® Insurance AgentSimple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.